Managing personal finances can often feel overwhelming, especially when it comes to budgeting and ensuring you’re saving enough for the future. With so many strategies and approaches out there, it’s easy to get lost in the complexity. However, one budgeting method has stood the test of time due to its simplicity and effectiveness: the 50/30/20 rule.

This straightforward framework helps you divide your income into three clear categories—needs, wants, and savings or debt repayment—making it easier to allocate your money wisely. Whether you’re new to budgeting or looking for a more structured approach, the 50/30/20 rule offers a balanced way to live within your means, enjoy life today, and plan for a secure financial future.

In this post, we’ll explore the details of the 50/30/20 rule, how it works, and why it might be the ideal solution for managing your money with confidence.

What is the 50/30/20 Rule?

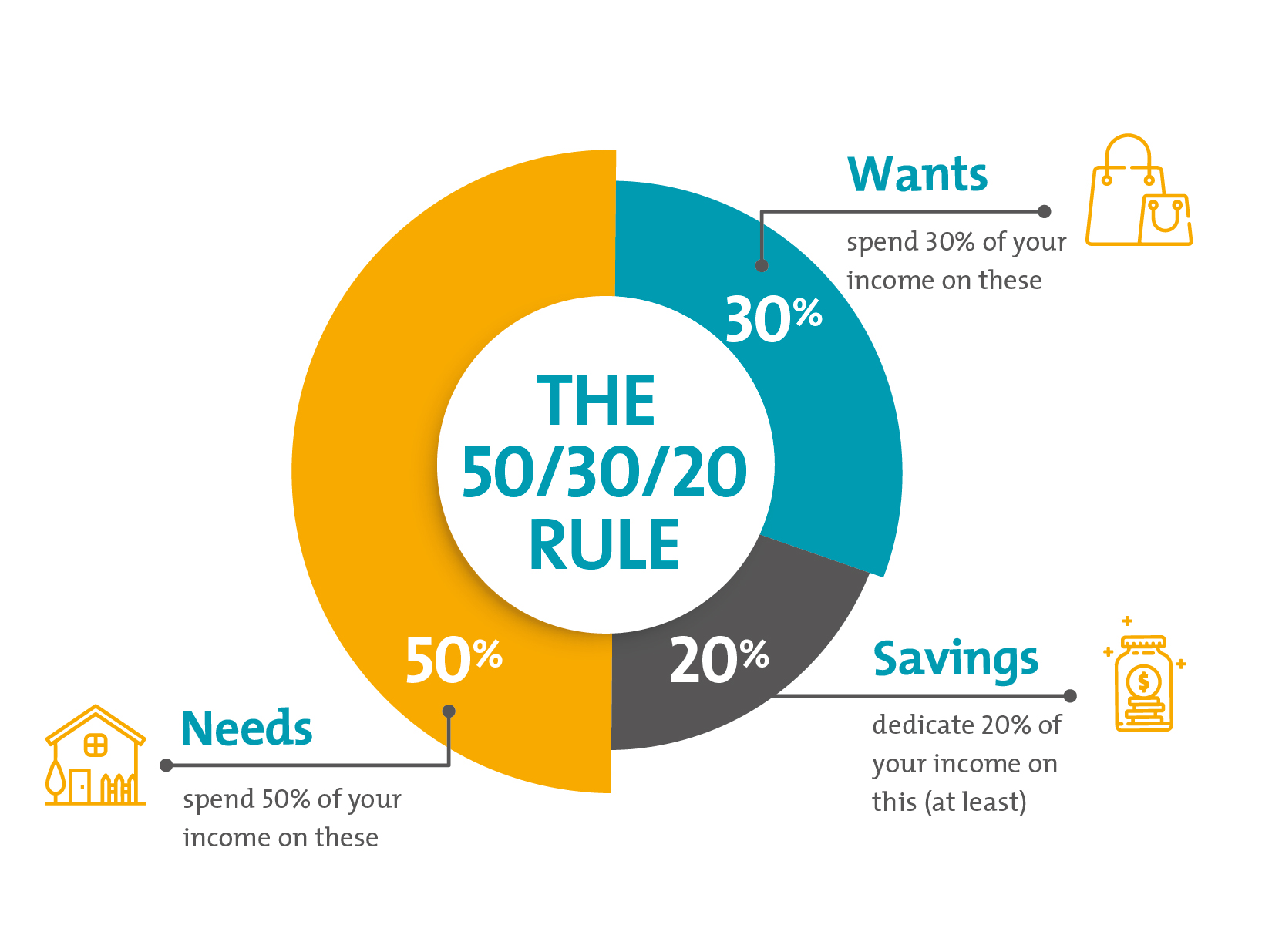

The 50/30/20 rule is a simple and popular budgeting strategy that helps individuals manage their income and expenses effectively. It provides a clear framework for how to divide your after-tax income into three main categories: needs, wants, and savings or debt repayment. The goal is to ensure a balanced approach to spending while also promoting financial health and long-term stability.

Breakdown of the 50/30/20 Rule

1. 50% for Needs (Essential Expenses)

This category includes all of your non-negotiable, essential expenses—the things you need to live and function day-to-day. These are the costs that you must cover no matter what.

Examples of “Needs” Include:

- Housing: Rent or mortgage payments, property taxes, and home insurance

- Utilities: Electricity, water, gas, internet, and phone bills

- Transportation: Car payments, insurance, fuel, public transportation costs

- Groceries: Essential food and household supplies

- Healthcare: Health insurance premiums, medical bills, prescriptions, and medical care

- Childcare or Education: Tuition, daycare, and school-related expenses

- Minimum debt payments: Monthly credit card or loan payments (just the minimum, not extra payments)

Why It’s Important:

Ensuring that 50% of your income goes toward essential expenses helps provide financial stability. These are necessary to keep you afloat in your daily life, so they should take top priority. If your “Needs” category exceeds 50%, it may indicate that you need to adjust some of your spending or rethink certain commitments to make room for other important categories.

2. 30% for Wants (Discretionary Spending)

Wants are the non-essential expenses that add enjoyment and comfort to your life but aren’t necessary for survival. This category gives you flexibility to indulge, but it’s important to remain mindful about not overspending here.

Examples of “Wants” Include:

- Dining Out: Restaurant meals, takeout, or coffee from a café

- Entertainment: Concerts, movies, streaming services, and hobbies

- Vacations and Travel: Trips, hotel stays, and activities for leisure

- Subscription Services: Magazine subscriptions, beauty boxes, or fitness memberships

- Shopping for Clothing or Electronics: Non-essential clothing, gadgets, or decor

- Gifts and Non-Essential Experiences: Special purchases for others or personal indulgences

Why It’s Important:

The 30% allocated to “Wants” gives you the freedom to enjoy life’s luxuries without overindulging. However, it’s crucial to stay within this limit to avoid overspending. Often, these expenses can easily get out of hand, especially with entertainment and dining. By keeping your discretionary spending within the 30% range, you still have room to save and pay down debt.

3. 20% for Savings and Debt Repayment

The remaining 20% of your income should go toward securing your financial future through savings or reducing debt. This category ensures you are building wealth over time and taking proactive steps toward financial goals, whether it’s building an emergency fund, saving for retirement, or paying off high-interest debt.

Examples of “Savings and Debt Repayment” Include:

- Emergency Fund: Savings set aside for unexpected expenses like medical bills, car repairs, or job loss

- Retirement Accounts: Contributions to a 401(k), IRA, or pension plan

- Debt Repayment: Extra payments on loans, credit card bills, or mortgages

- Investing: Investments in stocks, bonds, or real estate

- Education Savings: Contributions to a 529 plan or other educational funds

Why It’s Important:

Putting 20% of your income toward savings and debt repayment ensures that you’re building financial security. Whether it’s reducing financial stress by eliminating debt or investing for future goals, this portion of your budget allows you to live without worrying about unexpected costs and helps you achieve long-term financial freedom.

How to Implement the 50/30/20 Rule

- Assess Your Income:

The first step is to calculate your after-tax income. This includes your salary, bonuses, freelance income, or any other sources of money you receive regularly. Be sure to subtract any taxes that have already been taken out, so you’re working with the amount that ends up in your bank account.

- Track Your Spending:

Review your spending habits over a few months to understand where your money is going. Categorize your expenses into “needs,” “wants,” and “savings/debt.” This exercise will help you see if you’re sticking to the 50/30/20 split or if adjustments are needed.

- Set Realistic Limits:

Once you understand your income and spending patterns, create a budget based on the 50/30/20 rule. You may find that you need to make cuts in the “wants” category or adjust your savings plan. For example, if you’re spending too much on dining out, consider cooking at home more often to free up money for your savings or to pay off debt.

- Adjust and Fine-Tune:

While the 50/30/20 rule provides a solid foundation, it’s not set in stone. Your financial priorities may change over time. For instance, if you’re in a period of aggressive debt repayment, you may want to allocate more than 20% to pay off your debt. Or, if you’re saving for a specific goal, you could temporarily increase your savings percentage.

- Reevaluate Periodically:

Life changes, and so do your financial needs. It’s important to revisit your budget regularly to ensure that your 50/30/20 split still reflects your current situation and goals. You may need to shift money between categories as your needs evolve.

Why the 50/30/20 Rule Works

- Simplicity:

One of the key benefits of this rule is its simplicity. It breaks down budgeting into three easy-to-understand categories, making it accessible even for those who are new to budgeting.

- Balanced Approach:

The rule provides a balanced framework for living comfortably while prioritizing both short-term enjoyment and long-term financial health. It ensures you’re not depriving yourself but also saving enough for the future.

- Flexibility:

While the numbers are a good starting point, the rule offers flexibility. You can tweak the percentages based on your financial priorities. If you’re focused on paying off debt, you can allocate more to debt repayment and less to discretionary spending, and vice versa.

- Financial Freedom:

Following this rule helps you achieve a sense of financial control, reduce stress around money, and work towards your financial goals without feeling overwhelmed.

The 50/30/20 rule is an effective, simple way to manage your money, reduce overspending, and save for the future. It encourages a balanced approach to life’s pleasures and necessities while ensuring that you’re also planning. By sticking to this guideline, you can create a sustainable financial plan that works for you, all while living within your means and building wealth over time.

Also, see: 4 Small Business Ideas to Start in 2025.